To retire at a decent age and move to Hawaii, an engineer plans to trust her account to an investment firm that promises to make a real rate of return of 10% per year when the inflation rate is 4% per year. If the account currently is valued at $422,000 and she wants to retire in 15 years, how much (in then-current dollars) will have to be in the account for the realized rate of return to be a real 10% per year? Also, write a single-cell spreadsheet function to display the answer.

What will be an ideal response?

Account will have to grow at rate of if

if = 0.10 + 0.04 + (0.10)(0.04) = 0.144 (14.4%)

Amount required: F = 422,000(F/P,14.4%,15)

= 422,000(7.52299)

= $3,174,701

Function: = - FV(0.1+0.04+0.1*0.04,15,,422000) displays $3,174,701

You might also like to view...

The formula for cubic feet is length times width times thickness divided by 144

Indicate whether the statement is true or false

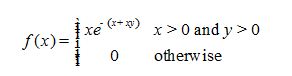

For continuous random variables X and Ywith joint probability density function

a. Find P(X > 1 and Y > 1).

b. Find the marginal probability density functions  and

and

c. Are X and Y independent? Explain.

Why have some digital meters added an analog sliding scale?

What will be an ideal response?

If a 1 MHz carrier is amplitude modulated with a 7 KHz signal what are the frequency components (upper and lower side bands)?

A) 140 KHz and 280 KHz B) 14 KHz and 28 KHz C) 1.07 MHz and 1.7 MHz D) 1.007 MHz and 993 KHz