China America Manufacturing is evaluating two different operating structures which are described below. The firm has annual interest expense of $250, common shares outstanding of 1,000, and a tax rate of 40 percent.

(a) For each operating structure, calculate

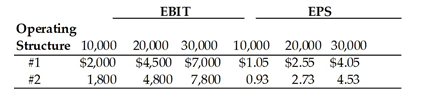

(a1) EBIT and EPS at 10,000, 20,000, and 30,000 units.

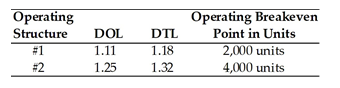

(a2) the degree of operating leverage (DOL) and degree of total leverage (DTL) using 20,000 units as a base sales level.

(a3) the operating breakeven point in units.

(b) Which operating structure has greater operating leverage and business risk?

(c) If China America projects sales of 20,000 units, which operating structure is recommended?

(a1)

(a2) and (a3)

b) Operating structure 2 has greater fixed costs, greater operating leverage, and greater business risk than operating structure 1.

(c) If sales are projected at 20,000 units, China America Manufacturing should choose operating structure 2 because it results in a higher EBIT and EPS for the firm. Operating structure 2 has a higher operating breakeven point, but with sales estimated at 20,000 units versus a breakeven point of 4,000 units, the firm should take advantage of the added leverage.

You might also like to view...

Which of the following is the best way for an auditor to determine that every name on a company's payroll is that of a bona fide employee presently on the job?

A. Examine employees' names listed on payroll accounting records. B. Visit the working areas and confirm with employees their badge or identification numbers. C. Make a surprise observation of the company's regular distribution of paychecks. D. Examine personnel records for accuracy and completeness.

What is the term for something that is produced by the mind, such as a new invention, that has commercial value?

A) Identity-based property

B) Decision support systems

C) Knowledge information systems

D) Management information systems

E) Intellectual property

Which of the following is true? The results of operations of a component of an entity that either has been disposed of or classified as held for sale shall be reported in discontinued operations if: I. The operations and cash flows of the component have been or will be eliminated from the ongoing operations of the entity as a result of the disposal transaction. II. The entity continues to have a

significant continuing involvement in the operations of the component after the disposal transaction. III. The entity outsources the manufacturing operations of a component and sells the manufacturing facility of the component but continues to sell the product formerly manufactured by the facility sold. a. I, II, and III are all true. b. I and II are true, but III is not. c. Only II is true. d. Only I is true.

By displaying main ideas on a computerized projection, chart, poster, overhead, transparency, or slide, you

a. help your listeners follow your presentation. b. interrupt your listeners from following your presentation. c. do not allow your listeners to follow your presentation. d. overcrowd your presentation.