Analyze the following statement, and show what would happen in the long run if such advice were followed by the Fed: "The increase in the stock market has increased people's wealth. As a result, their consumption has increased, increasing aggregate demand and output. So the Fed needs to increase the money supply, since with higher income, people's demand for real money balances will be higher."

What will be an ideal response?

Assuming resources are fully utilized, there will be no increase in output. Higher wealth will reduce saving, shifting the IS curve up and to the right. Increasing the money supply shifts the LM curve down and to the right. But general equilibrium will require the LM curve to shift up and to the left. So the price level must rise, and it rises even more because of the monetary policy suggested by the statement. The correct monetary policy for preventing inflation is to reduce, not increase, the money supply.

You might also like to view...

Changing the price of good Y will

A. only affect the demand for that good. B. have effects across some markets. C. keep prices down in all markets. D. have no effect.

Per capita GNP and quality-of-life are the only ways to determine a country's level of economic development

a. True b. False Indicate whether the statement is true or false

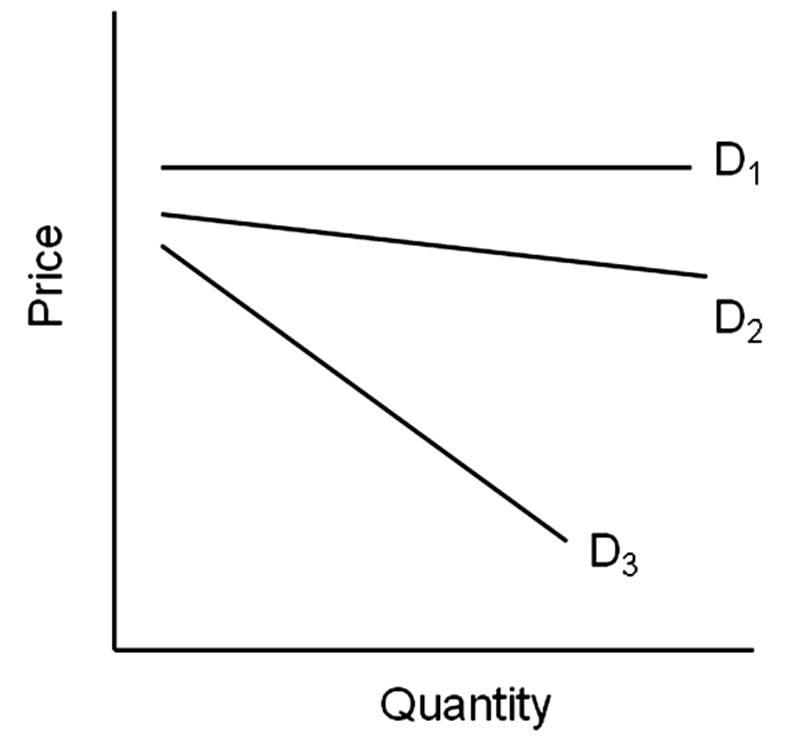

If demand curve D2 represents a monopolistic competitor and demand curve D3 represents a monopoly, then

A. the monopolist has a more elastic demand curve than the monopolistic competitor.

B. the monopolistic competitor has a more elastic demand curve than the monopolist.

C. the monopolist and the monopolistic competitor have identical elasticity in their demand curves.

D. None of these choices are true.

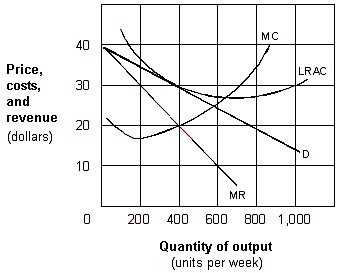

Exhibit 10-3 A monopolistic competitive firm in the long run

A. zero. B. $10 C. $20. D. $30.