Insurance works because it:

A. reallocates the costs of unforeseen events, sparing any individual from taking the full hit.

B. prevents any one individual from experiencing all the unforeseen events.

C. makes it less likely that their clients will experience unforeseen events.

D. None of these statements is true.

Answer: A

You might also like to view...

If a product becomes more popular and consumers want more produced, which of the following best describes what happens to move more factors of production into that industry?

A) An agency of the Federal government directs the movement of factors. B) The chief executive officers or presidents of corporations require that factors leave one industry and move to the other industry. C) Factor owners voluntarily move their factors because they want to satisfy the interests of consumers. D) Wages, rent, interest, and profit increase in that industry, thereby giving factors the incentive to move to that industry. E) Consumers increase their demand for the products and, as a result, the taxes the producers must pay decrease enabling the producers to hire more factors of production.

The most heavily traded American stocks are traded on the

a. New York Stock Exchange. b. American Stock Exchange. c. regional stock markets. d. "third market."

Workers who work the night shift are often paid more than those who do identical work on the day shift. This is referred to as a

a. discriminatory wage practice. b. compensating differential. c. wage inequity. d. a market inefficiency.

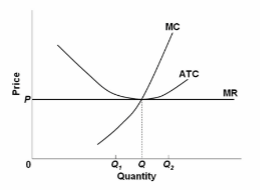

The diagram portrays:

A. a competitive firm that should shut down in the short run.

B. the equilibrium position of a competitive firm in the long run.

C. a competitive firm that is realizing an economic profit.

D. the loss-minimizing position of a competitive firm in the short run.