What must be done to net domestic product at factor cost in order to transform it to gross domestic product? Explain why these adjustments are necessary

What will be an ideal response?

Several adjustments must be made to net domestic product at factor cost in order to set it equal to GDP. First, indirect taxes must be added and subsidies must be subtracted. These changes are necessary because GDP is measured using market prices whereas net domestic product at factor cost measures what the goods and services cost to produce. The price can be different than the cost when there are taxes and subsidies present. Thus taxes must be added to the cost and subsidies subtracted in order to determine the price that was actually paid. (For instance, a DVD might cost $20 but a $1 sales tax makes the price $21.) Then, the second adjustment is that depreciation also needs to be added. Depreciation is the wear and tear on capital when it is used and when it becomes obsolete. GDP includes expenditure on investment and some investment is used to replace the capital stock that has depreciated. So, when calculating GDP using the income approach, depreciation must be included. But depreciation is not included in net domestic product at factor cost because that amount includes only payments made (as income) to the inputs that helped produce the products and no payment is made for the depreciation of capital. So the addition of depreciation (as well as the adjustments for taxes and subsidies) is necessary in order to convert net domestic product at factor cost into GDP.

You might also like to view...

Explain the share-the-gains, share-the-pains theory. How does it differ from the capture hypothesis?

What will be an ideal response?

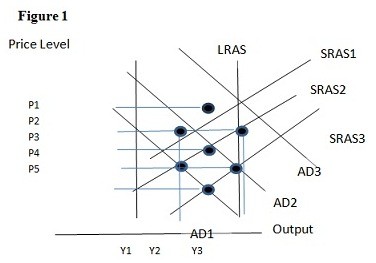

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

A firm should shut down in the short run if it s AVC is less than the price it receives per unit of the good.

Answer the following statement true (T) or false (F)

In July 2020, $1 was worth 45 Indian rupees and in July 2020, $1 was worth 55 Indian rupees. We can therefore conclude that

A. the Indian rupee depreciated. B. the value of the U.S. dollar has fluctuated. C. the Indian rupee appreciated. D. the U.S. dollar has depreciated.