Compilation reports and disclosures You have been engaged to perform a compilation service for Raven Company. Management informs you that it will not include the required disclosures in the financial statements. What effect will this have on the engagement?

The request by the client to omit substantially all of the required disclosures may be honored if the CPA believes that such omission is not undertaken to mislead the users. Such omission implies that the CPA is familiar with the users and knows enough about the financial statements to conclude that the omission is not intended to mislead the users. The compilation report should include a paragraph that indicates that the disclosures have been omitted.

You might also like to view...

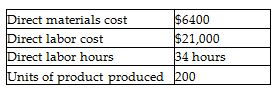

Jordan Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, it estimated the manufacturing overhead rate to be 30% times the direct labor cost. In the month of June, Jordan completed Job 13C, and its details are as follows:

What is the cost per unit of finished product of Job 13C? (Round your answer to the nearest cent.)

A) $168.50

B) $146.60

C) $137.05

D) $136.50

Stock options often are granted by a corporation to management personnel as a means of additional compensation and motivation of these employees

Indicate whether the statement is true or false

Bearer instruments are transferred by negotiation

Indicate whether the statement is true or false

Arbor, Inc. had overhead of $310,000 during the year when $260,000 in labor costs were incurred. Estimates at the start of the year for overhead and labor costs were $300,000 for overhead and $250,000 for labor costs. The predetermined overhead rate would be:

A. 83.33%. B. 120.00%. C. 104.00%. D. 101.67%.