Three years ago Dr. and Mrs. Henderson moved from the house they had owned for 20 years, but did not sell it. They decided to travel and bought a mobile home to live in. They now sell the house. How much of their capital gain on the house will be taxable?

A) 15 percent, depending on their tax bracket

B) 28 percent, depending on their tax bracket

C) All of it, if it is over $500,000

D) None of it, if it is less than $500,000

Answer: D) None of it, if it is less than $500,000

You might also like to view...

Starting from long-run equilibrium, a war that raises government purchases results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; potential C. higher; higher D. lower; higher

Refer to Figure 5-13. The market equilibrium quantity of gasoline is ________ million gallons per month

A) 20 B) 32 C) 48 D) 56

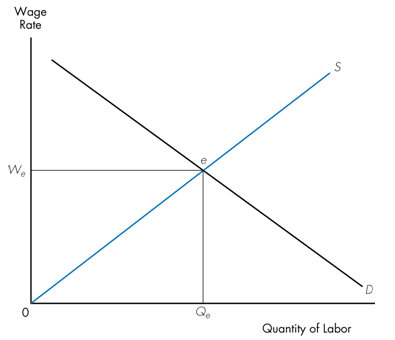

Refer to the graph below. An effective minimum wage would be set

a. above We and would create a surplus of labor.

b. below We and would create a surplus of labor.

c. above We and would create a shortage of labor.

d. below We and would create a shortage of labor.

Suppose that Argentina's dollar-denominated external assets and liabilities are $10 billion and $100 billion, respectively, and its Argentine peso-denominated external assets and liabilities are each 50 billion pesos (P). Suppose further that Argentina fixes its exchange rate at P1 = $US1. What is the peso value of Argentina's total external wealth?

A) -60 billion pesos B) -150 billion pesos C) -0 billion pesos D) -90 billion pesos