For each transaction below, calculate the amount of expense to be recognized in the current period using accrual-basis accounting:(a) Paid $3,500 on account for supplies purchased last period. All supplies were used last month.(b) Paid $5,000 cash for advertising in the current period.(c) Employees worked in the current period but will not be paid until the following period, $4,500.

What will be an ideal response?

(a) $0; (b) $5,000; (c) $4,500.

Transaction (a) represents the payment of a liability for expenses incurred in a previous period.

You might also like to view...

______ are independent workers who supply organizations with short-term talent for projects that need to be completed within a certain amount of time.

What will be an ideal response?

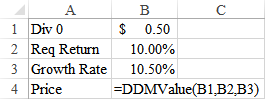

Below is the code for the function DDMValue. What is the outcome in B4?

Public Function DDMValue(Div0 As Single, ReqRate As Single, GrowthRate As Single) As Single

If ReqRate > GrowthRate Then

DDMValue = Div0 * (1 + GrowthRate) / (ReqRate - GrowthRate)

Else

DDMValue = CVErr(xlErrValue)

End If

End Function

a) #VALUE!

b) -$110.50

c) $110.50

d) $55.64

e) $27.34

The use of short-term incentives to encourage the purchase of a product or service is called ________

A) direct marketing B) sales promotion C) advertising D) public relations E) publicity

A recommended technique for dealing with a stressful conversation is to

A) rehearse in advance what you intend to say. B) use intimidation tactics during the conversation. C) hold the conversation on Monday. D) hold the conversation on Friday.