Suppose that the government increases taxes. One effect of this change is that it decreases

a) disposable income, which decreases consumption expenditure and aggregate demand

b) government expenditure, which decreases aggregate demand

c) the size of the government expenditure multiplier

d) disposable income which then decreases aggregate supply

c) the size of the government expenditure multiplier

You might also like to view...

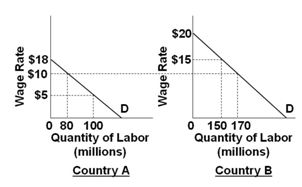

Refer to the below graphs. (Assume that the pre-migration labor force in Country A is 100 and that it is 150 in country B.) What part of domestic output in country B is the total wage bill before and after the immigration?

A. $1,700M before and $2,250M after

B. $2,250M before and $1,700M after

C. $1,500M before and $2,250M after

D. $1,700M before and $1,500M after

Suppose that the basket of goods purchased by the typical consumer costs $188.80 this year and it cost $160 in the base year. The CPI in the base year would be

A) 85.11. B) 100.0. C) 118.0. D) 348.8.

Which of the following gives rise to a positive externality?

A) Sudden increase in the price of oil due to a supply shock B) Sudden increase in the demand for diamonds leading to an increase in their price C) Deforestation leading to the extinction of many species D) Consumption of a drug to cure a communicable disease

The supply of public school places is determined by

(a) individuals' demand for education. (b) direct and indirect costs of schooling. (c) political processes, often unrelated to economic criteria. (d) all of the above.