The interest rate effect and real wealth effect are important because they help to explain

A. why demand management policy cannot be used effectively when aggregate supply shifts to the left.

B. the downward-sloping nature of the aggregate demand curve.

C. why equilibrium real GDP rarely coincides with potential real GDP.

D. why the aggregate demand curve may shift inward or outward.

B. the downward-sloping nature of the aggregate demand curve.

You might also like to view...

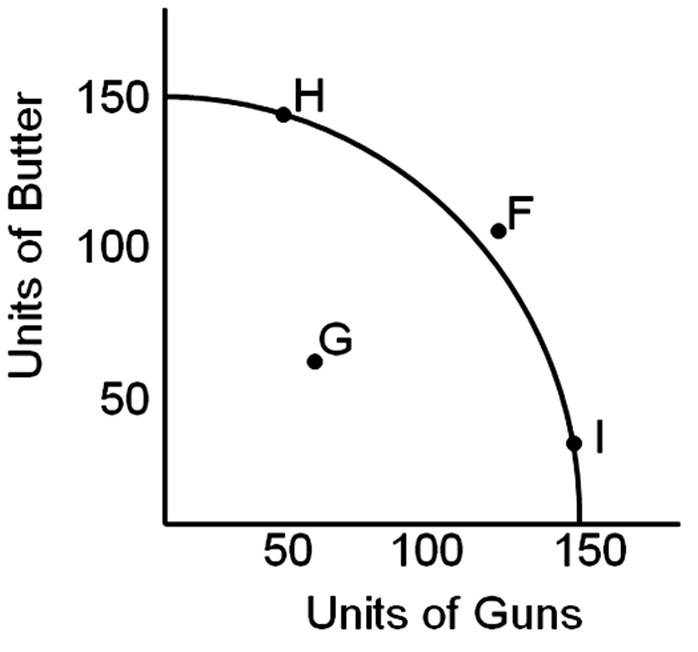

Which point best represents the economy in a depression?

A. Point H

B. Point F

C. Point I

D. Point G

Real GDP per capita is found by

A. dividing population by real GDP. B. subtracting population from real GDP. C. dividing real GDP by population. D. adding real GDP and population.

As the manager of good A, which of the following would be of greatest concern (based on the regression results above)?

A) None of the factors below would be of concern. B) an impending recession C) pressure on you by your salespersons to lower the price so that they can boost their sales D) a price reduction by the makers of good B

Which of the following would cause a decrease (leftward shift) in the short-run aggregate supply curve (SRAS)? a. An increase in oil prices. b. An advance in technology

c. An increase in the CPI. d. An increase in the long-run aggregate supply curve (LRAS).