What determines tax revenues?

A. the income tax rate

B. the rate of inflation

C. the money supply in the economy

D. the rate of interest

Answer: A

You might also like to view...

A demand-pull inflation initially is characterized by

A) increasing real output and a labor surplus. B) no change in real output and a labor shortage. C) decreasing real output and a labor surplus. D) decreasing real output and a labor shortage. E) increasing real output and a labor shortage.

Assume a decrease in interest rates causes an initial increase in desired investment and aggregate demand. Additional increases in aggregate demand will

A. Be caused by increases in induced expenditures. B. Be insignificant compared to the initial increase. C. Be caused by multiplier-induced increases in autonomous investment. D. Not occur.

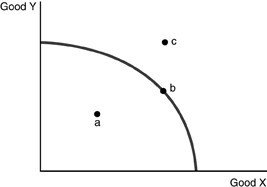

Refer to the above figure. Which of the following statements is TRUE?

Refer to the above figure. Which of the following statements is TRUE?

A. Point a is inefficient, point b is efficient and point c is unobtainable. B. Point a is efficient, Point b is efficient, point c is inefficient. C. Point a is unobtainable, point b is efficient and point c is inefficient. D. All of the points are efficient.

The diamond/water paradox helps to illustrate the concept of marginal value.

Answer the following statement true (T) or false (F)