The yield on a thirty-year Treasury bond is 8% at the same time as the yield on two-year Treasury note is 5%. This occurrence

A) indicates that the yield curve is downward sloping.

B) is well explained by the segmented markets theory.

C) is largely explained by the favorable tax treatment of Treasury notes.

D) indicates that the bond market is anticipating that inflation will fall.

B

You might also like to view...

Under the Bretton Woods system, a country with a balance of payments deficit

a. could get loans from the U.S. government. b. could devalue if deflationary policies failed to eliminate the deficit. c. was not allowed to devalue under any circumstance. d. was required to devalue its currency immediately.

Suppose that the MPC is 0.7, there is no investment accelerator, and there are no crowding-out effects. If government expenditures increase by $30 billion, then aggregate demand

a. shifts rightward by $100 billion. b. shifts rightward by $51 billion. c. shifts rightward by $170 billion. d. shifts rightward by $72.8 billion.

In regression analysis, the standard errors should not always be included along with the estimated coefficients. ?

Answer the following statement true (T) or false (F)

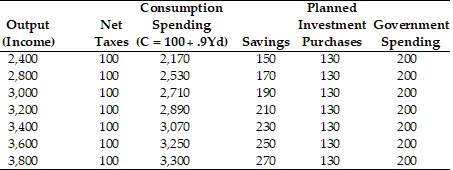

Refer to the information provided in Table 24.6 below to answer the question(s) that follow.Table 24.6All Figures in Billions of Dollars Refer to Table 24.6. The equilibrium level of income is

Refer to Table 24.6. The equilibrium level of income is

A. $3,800 billion. B. $3,600 billion. C. $3,400 billion. D. $2,000 billion.