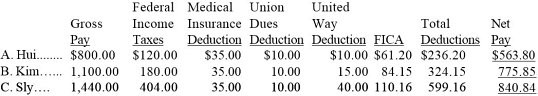

The payroll records of a company provided the following data for the current weekly pay period ended March 12.?Earningsto End of?Federal Medical??PreviousGrossIncomeInsuranceUnionUnitedEmployees Week Pay Taxes DeductionDuesWayD. Hui…….$ 5,800 $800 $120 $35 $10 $10B. Kim……. 6,850 1,100 180 35 10 15C. Sly…... 12,900 1,440 404 35 10 40Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for each employee.

What will be an ideal response?

You might also like to view...

By using the SPIN approach, salespeople hope to receive the prospect's approval for analyzing a problem.

Answer the following statement true (T) or false (F)

Destructive leaders such as Hitler and those who lead White supremacy groups gain followers because they prey on people’s psychological need to ______.

A. become well-known B. feel secure C. feel powerless D. feel chosen or special

Inflection, a trait of good voice quality, is the

a. loudness of the voice. b. rising and falling of the voice. c. pronunciation of words. d. enunciation of words.

Which is the correct formula for productivity growth rate? Assume that P1 is the productivity in the period before period P2.

a. (P1 – P2)/P2 b. (P1 + P2)/P1 c. (P2 – P1)/P1 d. (P1 + P2)/P2