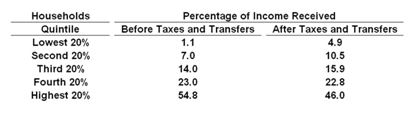

Refer to the below table. The decline in percentage of income received from before taxes and transfers to after taxes and transfers is greatest for the:

A. Second 20% of households

B. Third 20% of households

C. Fourth 20% of households

D. Highest 20% of households

D. Highest 20% of households

You might also like to view...

Monetarists believe that changes in the supply of money

A) do not affect aggregate demand. B) affect aggregate demand through the loanable funds market only. C) affect only the investment component of aggregate demand. D) affect aggregate demand directly.

Which of the following is an example of a public good?

A. Social Security payments. B. Flood control. C. Carpooling with your friends. D. None of the choices are correct.

If the price elasticity of demand is elastic, then:

A. Ed < 1. B. consumers are relatively not very responsive to a price increase. C. an increase in the price will increase total revenue. D. there are likely a large number of substitute products available.

Which statement is false?

A. The most important determinant of the degree of elasticity is the availability of substitutes. B. An elasticity of less than 1 is inelastic. C. The advertiser wants to push her product's curve to the left and make is less elastic. D. None of these statements are false.