Explain why selling output at a price below that at which marginal revenue equals marginal cost (MR = MC) might serve to deter entry of a potential competitor

What will be an ideal response?

If a potential entrant is unsure about the existing firm's marginal cost it might believe that the firm is maximizing profits at its chosen price and quantity combination and will conclude that profits are low in this industry. As a result, the potential entrant might believe it cannot compete with the existing firm. Alternatively, the potential entrant might view the low profits as inadequate incentive to enter the industry.

You might also like to view...

Which of the following statements about third-degree price discrimination is correct?

A. Successful third-degree price discrimination will generally result in a greater level of output than would be the case under a single-price pure monopoly. B. Successful third-degree price discrimination does not require that different groups of consumers have different demand elasticities. C. Successful third-degree price discrimination does not require that the producer separates customers into easily identifiable groups. D. Successful third-degree price discrimination will not provide the firm with more total profits than if it does discriminate.

Except for perfect substitutes or perfect complements, indifference curves

A) are straight lines with a positive slope. B) slope upward to the right. C) are bowed in toward the origin. D) are bowed out away from the origin.

What is the Fed's monetary policy instrument?

What will be an ideal response?

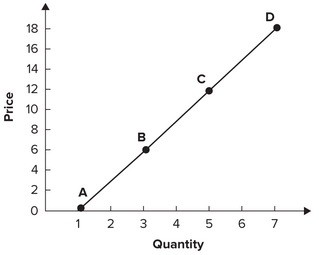

Refer to the graph shown. The approximate elasticity of segment AB is:

A. 3/2. B. 2/3. C. 1/2. D. 1/3.