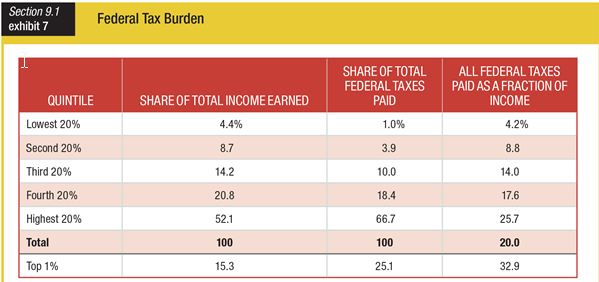

Based on the table for the federal tax burden, the lowest 20% of earners pays about what percent of total federal taxes?

a. 1.0

b. 4.2

c. 4.4

d. 52.1

a. 1.0

You might also like to view...

Given that the characteristics of Social Security are determined through the political process, we would expect that young workers would _____ when given the opportunity to vote on the program

a. oppose increases in Social Security taxes b. oppose increasing the retirement age c. oppose means-testing of retirees d. be strongly in favor of the status quo

Unlike the minimum wage, the Earned Income Tax Credit does not:

A. cost the government money. B. cause low-wage workers to be laid off. C. increase total economic surplus. D. improve the economic well-being of the working poor.

If a British student pays her way to attend Harvard University, her action will:

A) cause the exchange rate of the British pound to rise. B) cause the exchange rate of the U.S. dollar to fall. C) change the supply of dollars in the foreign currency market. D) change the supply of pounds in the foreign currency market.

The market tends to underproduce public goods.

Answer the following statement true (T) or false (F)