Table 1.1 shows the hypothetical trade-off between different combinations of Stealth bombers and B-1 bombers that might be produced in a year with the limited U.S. capacity, ceteris paribus.Table 1.1Production Possibilities for BombersCombinationNumber of B-1 BombersOpportunity cost(Foregone Stealth)Number of Stealth BombersOpportunity cost (Foregone B-1)S0NA10 T1 9 U2 7 V3 4NAThe highest opportunity cost anywhere in Table 1.1 for Stealth bombers in terms of B-1 bombers is

A. 0.5 B bombers

B. 3 B bombers

C. 2 B bombers

D. 1 B bombers

Answer: D

You might also like to view...

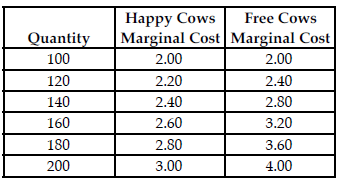

Refer to the table below. Suppose the perfectly competitive market for dairy products had a 40 percent chance of a high price of $3.00 and a 60 percent chance of a low price of $2.00. However, both Happy Cows and Free Cows have revised their probabilities and now believe that the probability of a high price of $3.00 is 80 percent and the probability of a low price of $2.00 is 20 percent. If the

managers of Free Cows want to maximize expected profit based on the new probabilities by how much will they change the quantity produced?

Happy Cows and Free Cows are two separate perfectly competitive dairy farms. The table above shows the respective firms' marginal cost at various production levels.

A) Free Cows will increase their production by 40 units.

B) Free Cows will decrease their production by 40 units

C) Free Cows will decrease their production by 20 units.

D) Free Cows will increase their production by 20 units.

Why are most endangered species belong to common property?

What will be an ideal response?

Suppose each of the following news items appears on the evening news. Which one would most likely cause consumption spending to increase?

a. "Layoffs reach record high" b. "Government to increase taxes with the start of the next quarter" c. "Stock market drops 10%" d. "Government to issue tax rebates at the end of next month" e. "Bankruptcies increase 20% over the last six months"

Relative to a no-trade situation, if the United States exported chairs, the domestic price of chairs

a. would rise, and domestic output would also rise. b. would decline, but the domestic output would rise. c. would decline, and domestic output would decline also. d. would rise, but domestic output would fall.