Hammacher Schlemmer Hammacher Schlemmer is a chain of retail stores famous for introducing a steady flow of innovative new products to customers. When it negotiates for a new product, it often requires that it will get the exclusive rights to retail it for a year or two. Why is it advantageous to the supply chain for there to be an exclusive dealer and why for only a few years?

Potential customers are unfamiliar with how most of these new products could benefit them. Hammacher Schlemmer must invest in customer education, advertising, and product demonstrations. Without exclusivity, another retailer could free-ride off of these services and undercut prices charged by Hammacher Schlemmer.

With enough time, the product is no longer new and customers become knowledgeable enough about the product that these demonstration services are less important. Further, when more retailers offer the product, they compete down retailer prices which will mitigate the double marginalization problem.

You might also like to view...

Which of the following is an example of peak-load pricing?

A) Charging less for vacations to Hawaii during December and January B) Charging more for electricity on hot days C) Setting price equal to marginal cost when there is a capacity constraint D) Selling excess capacity at lower prices

The difference between U.S. financial regulation between the 1930s-to-1980 period and the 1980-to-2010 period is:

a. The earlier period was characterized by relatively loose government regulations and the later one was characterized by stricter government regulations. b. The earlier period was characterized by heavy use of the originate-to-hold" strategy. c. The earlier period was characterized by recurring, nation-wide speculative housing bubbles. d. The earlier period was characterized by heavy use of securitization. e. All of the above.

What happens when the government imposes a unit excise tax on a good?

A. The amount of the tax is added to the current equilibrium price. B. That good's supply curve shifts down by the amount of the tax. C. The demand for the newly taxed good decreases. D. The newly taxed good's supply curve shifts vertically upward by the amount of the per-unit tax being levied.

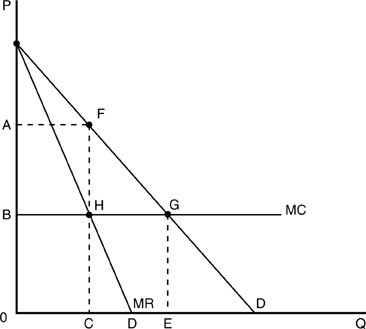

In the above figure, the difference between the competitive industry price and that of the monopolist is

In the above figure, the difference between the competitive industry price and that of the monopolist is

A. CE. B. 0B. C. 0A. D. AB.