The implicit assumption behind the Economic Recovery Tax Act of 1981, which cut the individual income tax rate by 25% over three years, was that

A. tax rate reductions will decrease supply in the economy and therefore choke off the high rate of inflation that the economy was experiencing.

B. the economy was on the positively sloped portion of the Laffer curve.

C. tax rate reductions will stimulate demand in the economy and move the economy to full employment.

D. the economy was on the negatively sloped portion of the Laffer curve.

Answer: D

You might also like to view...

If the demand for a product is elastic, the quantity demanded changes by a smaller percentage than the percentage change in price

Indicate whether the statement is true or false

Acme Widget tells investors it wants to build a new widget factory and sell investors $10,000,000 in bonds to finance it

Once they have raised the $10,000,000 the owners of Acme Widget use the funds to finance a trip to Atlantic City to try out a new scheme they have devised to win at blackjack. This is an example of A) the adverse selection problem in financial markets. B) the moral hazard problem in financial markets. C) the difficulty lenders have in distinguishing good from lemon firms. D) the problems with using rational expectations in financial markets.

If the interest rate increases, then the:

A. economy will move to a new point along the existing consumption function. B. consumption function will shift up. C. consumption function will shift down. D. investment demand curve will shift up.

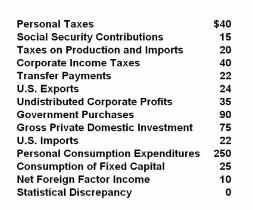

Refer to the data. NDP is:

Answer the question on the basis of the following data. All figures are in billions of dollars.

A. $370.

B. $402.

C. $392.

D. $467.