In the United States, the individual income tax is best described as a

a. regressive tax

b. proportional tax

c. flat tax

d. progressive tax

e. repressive tax

D

You might also like to view...

The president of the ________ Federal Reserve Bank is always a member of the FOMC

A) Washington, D.C. B) Boston C) New York D) Minneapolis

Which of these situations limit the use of ownership in resolving incentive problems?

A. The employees are well trained and highly qualified. B. The employees lack full control over their output. C. The employees try to maximize their personal utility. D. The actions of employees are unobservable.

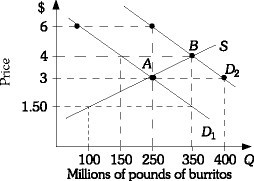

Refer to the information provided in Figure 3.18 below to answer the question(s) that follow. Figure 3.18Refer to Figure 3.18. The market is initially in equilibrium at Point A. If demand shifts from D1 to D2 and there is an excess demand of 150 million pounds of burritos, the price of burritos would be

Figure 3.18Refer to Figure 3.18. The market is initially in equilibrium at Point A. If demand shifts from D1 to D2 and there is an excess demand of 150 million pounds of burritos, the price of burritos would be

A. $1.50. B. $3.00. C. $4.00. D. $6.00.

The United States experienced a zero interest rate bound

A. in the 1970s. B. in the 1980s. C. in the 1990s. D. starting at the end of 2008.