In a small open economy, describe what happens when an increase in wealth causes national saving to decline. Explain the impact on the real interest rate, saving, investment, net exports, and absorption in equilibrium

What will be an ideal response?

With the saving curve shifting to the left in a small open economy, in equilibrium, saving declines, but investment and the real interest rate are unchanged. Since NX = S - I, NX declines. Since absorption equals output minus net exports, and net exports decline, then absorption increases.

You might also like to view...

If we wanted to consider all the money that had been "multiplied" in the economy, we would think about:

A. hard money. B. M1. C. M2. D. None of these.

The government can safely take on more debt

a. as long as private firms are taking on more debt b. as long as the debt involves no interest payments c. if GDP is growing faster than the debt is growing d. if the interest rate is below 3 percent e. as long as the debt is growing by less than 3 percent per year

Lately, the ratio of debt to GDP has been

A. rising at a small rate. B. rising steadily. C. falling modestly. D. staying constant.

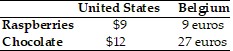

Refer to the information provided in Table 33.3 below to answer the question(s) that follow. Table 33.3 Refer to Table 33.3. If the exchange rate is $1 = 2 euros, then

Refer to Table 33.3. If the exchange rate is $1 = 2 euros, then

A. the United States will import both raspberries and chocolate. B. the United States will import raspberries and Belgium will import chocolate. C. Belgium will import both raspberries and chocolate. D. Belgium will import chocolate.