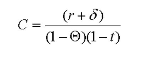

Assume that the user cost of capital (C) is simply

where r is the after tax rate of return, ? is the depreciation rate, ? is the corporate tax rate and,

r is the individual tax rate. Now assume further that the after-tax rate of return is 10 percent

and the economic depreciation rate is 2 percent. The firm faces corporate taxes of 35 percent

with an individual tax rate of 25 percent. Suppose that we now know that the present value of

depreciation allowances is 0.20. In addition, there is an investment tax credit of 0.10. What

effect does this new information have on the user cost of capital?

Solving for C yields C = (0.10 + 0.02)/(1 - 0.35)(1 - 0.25) = 0.2462 or 24.62%. Then multiply it

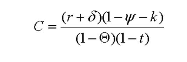

by (1 - 0.20 - 0.10). In the presence of depreciation allowance and investment tax credit, the

cost of capital can be calculated as:

where ? is the depreciation allowance and k is the investment tax credit. Therefore, we have

0.2462(1 - 0.20 - 0.10) = 0.1723 or 17.23%. The user cost of capital is now lowered.

You might also like to view...

Tradeoffs involve an exchange of one thing for another because resources are limited and can be used in different ways

Indicate whether the statement is true or false

A lawyer running his own business earns $18,000 in revenue monthly. He pays $8,000 as explicit costs including staff salary and utilities. He owns the office space so no rent is paid

The lawyer could work for other legal firms and earn $10,000 per month. His business profit is ________ and his economic profit is ________. A) $10,000, $10,000 B) $28,000, $10,000 C) $10,000, $0 D) $8,000, $0

Asymmetric information arises when:

a. both the parties to an exchange have perfect information about the good. b. none of the parties to exchange have any information about the good. c. one party to an exchange knows more than the other party. d. a good is provided by the government. e. the market is perfectly competitive.

Using only marginal revenue and marginal cost, we can determine whether a firm is incurring a profit or a loss

a. True b. False Indicate whether the statement is true or false