Suppose the interest parity condition holds. Also assume that the one-year interest rate in the United States is 6% and that the one-year interest rate in Canada is 6%. What does this imply about the current versus future expected exchange rate (for the U.S. and Canadian dollars)? Explain

What will be an ideal response?

This implies that there are no expected exchange gains or losses from holding foreign currency denominated assets for one year. So, the exchange rate that financial market participants expect to occur in one year is equal to the current exchange rate.

You might also like to view...

Which of the following does not describe a characteristic of short-term economic fluctuations?

A. Expansions and recessions are felt in only a few sectors of the economy. B. The unemployment rate rises during recessions. C. Durable-goods industries are more sensitive to short-term fluctuations than service and non-durable industries. D. Expansions and recessions are irregular in length and severity.

"Demand" refers to the relationship between the price of a good and the quantity consumers are willing and able to buy at each price

Indicate whether the statement is true or false

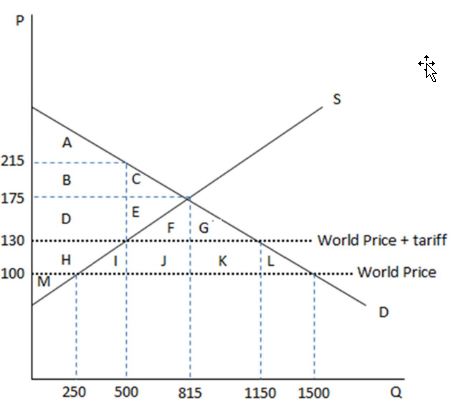

According to the graph shown, if the economy were open to free trade, the domestic quantity supplied would:

This graph demonstrates the domestic demand and supply for a good, as well as a tariff and the world price for that good.

A. drop from 815 to 500.

B. drop from 815 to 250.

C. increase from 250 to 500.

D. increase from 815 to 1500.

Which of the following is an example of a regulatory action?

a. Drivers who exceed the speed limit will pay a fine if caught. b. Automobile manufacturers are required to include built-in infant seats. c. Two firms receive $100,000 fines for engaging in a price-fixing agreement. d. A junk mail solicitor is taken to jail for mail fraud. e. The tobacco industry is required to pay for the hospital bills of a lifelong smoker who develops cancer.