Jim has estimated elasticity of demand for gasoline to be -0.7 in the short-run and -1.8 in the long run. A decrease in taxes on gasoline would:

a. lower tax revenue in both the short and long run.

b. raise tax revenue in both the short and long run

c. raise tax revenue in the short run but lower tax revenue in the long run.

d. lower tax revenue in the short run but raise tax revenue in the long run.

d

You might also like to view...

To maximize profit, manufacturers should set the ________ resale price that ________ the retailers' cost of providing product-specific services.

A) minimum; covers B) minimum; does not cover C) maximum; does not cover D) maximum; covers

With illegal immigration the unskilled labor supply curve:

a. shifts to the left. b. becomes perfectly inelastic. c. becomes perfectly elastic. d. shifts to the right. e. becomes non-existent.

A candidate for political office announces the following policies which, she says, economics clearly demonstrates will lead to higher output in the long run: 1 . increase immigration from abroad 2 . make trade more open between the US and other countries

a. 1 and 2 both shift long-run aggregate supply right. b. 1 and 2 both shift long-run aggregate supply left. c. 1 shifts long-run aggregate supply right, 2 shifts long-run aggregate supply left. d. 1 shifts long-run aggregate supply left, 2 shifts long-run aggregate supply right.

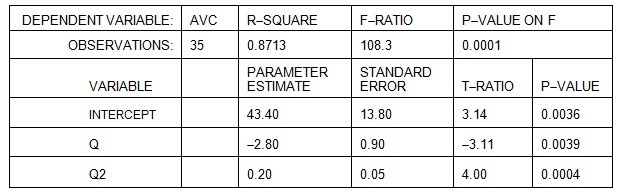

Straker Industries estimated its short-run costs using a U-shaped average variable cost function of the formAVC = a + bQ + cQ2and obtained the following results. Total fixed cost (TFC) at Straker Industries is $1,000.  If Straker Industries produces 12 units of output, what is estimated average variable cost (AVC)?

If Straker Industries produces 12 units of output, what is estimated average variable cost (AVC)?

A. $32.40 B. $38.60 C. $28.04 D. $33.33