Actions by the federal government that decrease the progressivity of the tax system:

A. decrease the amount of government spending.

B. increase the effects of automatic stabilizers.

C. increase the amount of taxation.

D. decrease the effects of automatic stabilizers.

Answer: D

You might also like to view...

U.S. GDP includes the market value of rental housing, but not the market value of owner-occupied housing services

a. True b. False Indicate whether the statement is true or false

Interest rate volatility is a problem because:

A. it decreases risk. B. financial decisions become less difficult when interest rates are more volatile. C. it can impact productivity in a positive way. D. it adds to uncertainty, thereby diminishing the investment.

In the simple circular flow model:

A. households are buyers of resources. B. businesses are sellers of final products. C. households are sellers of final products. D. there are real flows of goods, services, and resources, but not money flows.

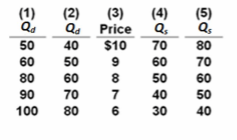

Refer to the table. In relation to column (3), a change from column (1) to column (2) would mostly likely be caused by:

A. reduced taste for the good.

B. an increase in input prices.

C. consumers expecting that prices will be lower in the future.

D. government subsidizing production of the good.