Which of the following is a difference between a tax and a subsidy?

a. A tax is money paid to the government, while a subsidy is money received from the government

b. There is a deadweight loss associated with a tax, while there is no deadweight loss associated with a subsidy.

c. A tax increases quantity supplied, while a subsidy decreases quantity supplied.

d. A tax increases consumer surplus, while a subsidy decreases producer surplus

a

You might also like to view...

A firm possesses too much capital if ________

A) the real rental cost of capital is equal to the marginal product of capital B) the real rental cost of capital is less than the marginal product of capital C) its investment spending exceeds its consumption outlays D) the real rental cost of capital is more than the marginal product of capital

The marginal cost to society of reducing pollution increases with the increased use of pollution abatement because

A) of the diminishing marginal utility of abatement. B) of the reduced demand for abatement. C) of the diminishing returns from abatement. D) of the high cost of abatement.

Which of the following is a microeconomic question?

A. Should the government decrease unemployment benefits to reduce the unemployment rate? B. Why do some countries have higher inflation rates than other countries? C. Should the government subsidize corn farmers to encourage the production of ethanol? D. Should congress decrease taxes to help stimulate the economy?

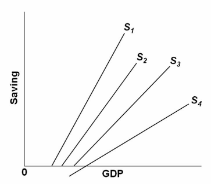

The figure shows the saving schedules for economies 1, 2, 3, and 4. Which economy has the largest multiplier?

A. 1.

B. 2.

C. 3.

D. 4.