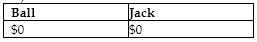

Ball Corporation owns 80% of Net Corporation's stock and Jack owns the remaining 20% of Net Corporation's stock. Ball's basis in the Net stock is $200,000 and Jack's basis in the Net stock is $100,000. Under a plan of complete liquidation, Ball Corporation receives property with an adjusted basis of $400,000 and an FMV of $800,000 and Jack receives property with an adjusted basis of $50,000 and

an FMV of $200,000. Ball and Jack's recognized gains on the liquidation are:

a.

b.

c.

d.

b.

You might also like to view...

__________ means performing different activities from rivals or performing similar ones in different ways.

A. Competitive planning B. Distinctive positioning C. Collaborative planning D. Strategic segmentation E. Strategic positioning

If we believe we are investing equally in a relationship’s future, we feel that we are sharing which of the following experiences?

A. Relationship has healthy climate. B. Relationship makes us unhappy. C. Relationship has healthy climate. D. Relationship has nowhere to go.

Which of the following is an element of SMART goals?

A. stellar B. timeless C. ambiguous D. measurable

A major challenge in developing good listening skills is that

A) most people speak more quickly than most people process information. B) most people process information more quickly than most people speak. C) too many people compete with each other to be good listeners. D) listening is discouraged in many jobs involving people contact.