In the U.S., taxes on capital gains are computed using

a. nominal gains. This is one way by which higher inflation discourages saving.

b. nominal gains. This is one way by which higher inflation encourages saving.

c. real gains. This is one way by which higher inflation discourages saving.

d. real gains. This is one way by which higher inflation encourages saving.

Answer: a. nominal gains. This is one way by which higher inflation discourages saving.

You might also like to view...

If demand is price elastic, a decrease in seller's total revenue would result from a(n)

a. decrease in price b. increase in quantity demanded c. increase in price d. decrease in income for an inferior good e. increase in total cost to the seller

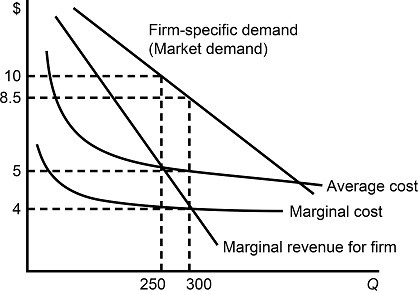

Figure 8.2 shows demand and costs for a monopolistically competitive firm. In the long run we expect:

Figure 8.2 shows demand and costs for a monopolistically competitive firm. In the long run we expect:

A. the firm to produce more output at a higher price. B. the firm to charge a price which is equal to its average cost of production. C. the firm to experience a decrease in the average cost of production. D. the firm to earn a greater profit.

A patent provides legal protection for an invention for

A) 7 years. B) 11 years. C) 20 years. D) as long as the invention is valuable.

The marginal rate of transformation is the slope of the production possibility frontier.

Answer the following statement true (T) or false (F)