What would be reported as Cost of Goods Sold on the income statement for the year ending December 31, 2019 if the perpetual inventory system and the weighted-average inventory costing method are used? (Round the unit costs to two decimal places and total costs to the nearest dollar.)

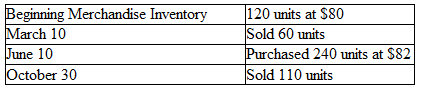

Cougar Company had the following balances and transactions during 2019:

A) $15,504

B) $24,480

C) $13,776

D) $8,976

C) $13,776

Cost of Goods Sold = $4,800 + $8,976 = $13,776

You might also like to view...

In which of the following ways did the charge to the Financial Accounting Standards Board (FASB) differ from that given to the Accounting Principles Board (APB)?

a. The FASB was to establish standards of financial accounting and reporting in the most efficient and complete manner possible. b. The FASB was to work toward standard setting with a two-pronged approach. c. The FASB was expected to stipulate principles of accounting as an underlying framework. d. The accounting standards established by the FASB were to be advisory rather than mandatory.

Getting enough quality sleep is one of the most effective strategies for managing the negative aspects of stress

Indicate whether the statement is true or false

The Place decisions are concerned with getting the right product to the target market at the right time.

Answer the following statement true (T) or false (F)

Stanton Inc. is considering the purchase of a new machine, which will reduce manufacturing costs by $5,000 annually and increase earnings before depreciation and taxes by $6,000 annually. Stanton will use the MACRS method to depreciate the machine, and it has estimated the depreciation expense for the first year as $8,000. Which of the following is the supplemental operating cash flow for the first year if Stanton's marginal tax rate is 40 percent?

A. $15,000 B. $23,000 C. $40,000 D. $9,800 E. $4,500