The cost of a subsidy to taxpayers is calculated by ______.

a. dividing the subsidy per unit by the number of units subsidized

b. multiplying the subsidy per unit times the number of units subsidized

c. subtracting the subsidy per unit from the total surplus

d. adding the subsidy per unit to the deadweight loss

b. multiplying the subsidy per unit times the number of units subsidized

You might also like to view...

The figure illustrates the market for bagels. If the number of bagels is increased from 20 to 30 an hour, consumer surplus plus producer surplus ________ and deadweight loss is ________

A) decreases; negative B) decreases; positive C) increases; positive D) increases; negative

In a two-sided market, an intermediary firm that links groups of producers and consumers is called

A) an operator. B) an oligopoly. C) a platform. D) an end user.

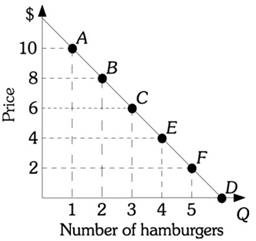

Refer to the information provided in Figure 5.2 below to answer the question(s) that follow. ?Figure 5.2Refer to Figure 5.2. If the price of a hamburger increases from $6 to $8, the price elasticity of demand equals ________. Use the midpoint formula.

?Figure 5.2Refer to Figure 5.2. If the price of a hamburger increases from $6 to $8, the price elasticity of demand equals ________. Use the midpoint formula.

A. -0.24 B. -1.0 C. -1.4 D. -2.0

What is the difference between explicit costs and implicit costs? List three examples each of explicit costs and implicit costs that may be experienced by a small business

What will be an ideal response?