What is the free-rider problem, and how is it related to public goods?

What will be an ideal response?

The free-rider problem arises from the exclusion principle. Since no one can be excluded from the benefits of a public good, even if they don't contribute towards paying for the good, people have an incentive to let other people pay for the good and to not contribute themselves. If everyone free rides, the good will not get produced. Hence, public goods usually are provided by the government and paid for by taxes.

You might also like to view...

The price charged by a perfectly competitive firm is

A) the same as the market price. B) different than the price charged by competing firms. C) lower the more the firm produces. D) higher the more the firm produces. E) indeterminate.

If the banking system has demand deposits of $200,000, total reserves equal to $60,000, and a required reserve ratio of 25 percent, the banking system can increase the volume of loans by a maximum of

A. $10,000. B. $60,000. C. $40,000. D. $200,000.

Stock market fluctuations

a. often go hand in hand with fluctuations in the economy more broadly. b. rarely have anything to do with fluctuations in the economy more broadly. c. have few, if any, macroeconomic implications. d. are attributable to the widespread belief that the efficient markets hypothesis is correct.

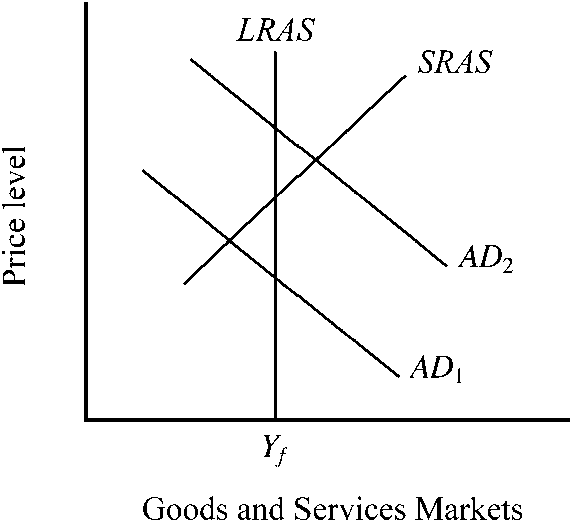

Figure 14-2

If the Fed anticipates that the conditions illustrated by AD1 and SRAS in will be present in the near future, it should

a.

shift to a more restrictive policy.

b.

shift to a more expansionary policy.

c.

request that Congress raise tax rates.

d.

refuse to buy any more U.S. securities.