Proponents of cuts in income tax rates argue that when income tax rates are cut, workers have an incentive to increase their work hours. This argument is based on the assumption that

A) workers are irrational.

B) workers make decisions based on the marginal benefit of each hour worked compared to the marginal cost of work.

C) the opportunity cost of working is negative.

D) the marginal cost of each additional work hour is not important to most workers.

E) workers make decisions based on the social interest.

B

You might also like to view...

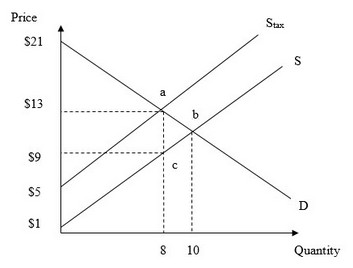

Use the figure below to answer the following question. What is the amount of consumer surplus after the government imposes the excise tax on the market?

What is the amount of consumer surplus after the government imposes the excise tax on the market?

A. $8 B. $40 C. $20 D. $32

What does it mean for a person or nation to have a comparative advantage in producing a product?

What will be an ideal response?

Which of the following would be a concern of normative economics?

a. measuring the actual distribution of income in the economy b. recommending a change in government policy to make the distribution of income more equitable c. determining the impact of higher income taxes on the distribution of income d. determining the impact of a lower federal budget deficit on the distribution of income e. measuring the change in the nation's income distribution since 1960

A balance-of-payments surplus can be reduced with

A. Increased tariffs and quotas on foreign goods. B. Increased government spending. C. Increased taxes. D. Contractionary monetary policy.