Compute the payback period for each investment. Show your calculations and round to one decimal place.

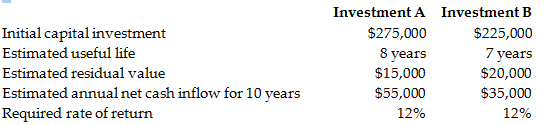

Zebulon, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:

Payback for Investment A = Amount invested / Expected annual net cash flow

= $275,000 / $55,000 = 5 years

Payback for Investment B = Amount invested / Expected annual net cash flow

= $225,000 / $35,000 = 6.4 years

You might also like to view...

The general structure of a phase model of negotiations involves

A. two phases: problem solving and resolution. B. three phases: problem solving, resolution, and implementation. C. four phases: preinitiation, initiation, problem solving, and resolution. D. three phases: initiation, problem solving, and resolution.

Under the Fair and Accurate Credit Transactions Act (FACTA),

a. a creditor may not discriminate against a borrower on the basis of race, sex, religion, or age. b. a debt collector may not harass or abuse debtors. c. a credit card company must promptly investigate and respond to any consumer complaints about a credit card bill. d. a consumer has the right to obtain one free credit report every year from each of the three major reporting agencies.

Briefly explain the difference between a USE of cash and a SOURCE of cash. Give examples of each. Briefly explain why managers want to know the uses and sources of cash

What will be an ideal response?

Practical uses of an income statement include

A) determining whether you are spending more than you earn. B) spotting problem areas of overspending. C) determining if money is available for saving or investing. D) knowing where your money is going. E) all of the above