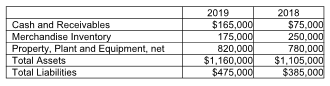

For the vertical analysis, what is the percentage of current assets as of December 31, 2019? (Round your answer to two decimal places.)

Allstate Moving Company reported the following amounts on its balance sheet as of December 31,

2019 and December 31, 2018:

A) 29.31%

B) 29.41%

C) 41.67%

D) 41.46%

A) 29.31%

You might also like to view...

On December 1, 20X8, Winston Corporation acquired 10 deep discount bonds from Linked Corporation at a cost of $400 per bond. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 10 bonds at $400 per bond. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow: December 1, December 31, February 20, 20X8 20X8 20X9Linked Corporation Per Bond: $400 ? ? Put Option (100 shares) Market Value $250 $400 $400 Intrinsic Value 0 ? 400 Time

Value $250 $100 ? Assume that Winston exercises the put option and sells Linked bonds on February 20, 20X9.Based on the preceding information, which of the following journal entries will be made on February 20, 20X9? A.Cash4,000 Available-for-Sale Securities 4,000B.Cash4,000 Put Option 400 Available-for-Sale Securities 3,600C.Loss on Hedge Activity150 Put Option 150D.Loss on Hedge Activity400 Available-for-Sale Securities 400 A. Option A B. Option B C. Option C D. Option D

If a retailer's gross margin is tracking below plan, which of these options would increase their gross margin?

A. Increase markdowns B. Negotiate better prices with vendors to decrease cost of goods sold C. Increase payroll D. Decrease utilities E. Defer paying taxes

HTML controls web browsers that access the web

Indicate whether the statement is true or false

If an analyst wants to value a potential investment in the common stock equity in a firm, the relevant cash flows the analyst should use are

a. free cash flow from operations b. free cash flows for all debt and equity capital stakeholders c. free cash flows to common equity shareholders d. cash flow from operations