Government decisions about the level of taxation and public spending are called:

A. fiscal policy.

B. monetary policy.

C. congressional policy.

D. legislative budgeting policy.

A. fiscal policy.

You might also like to view...

Starting from long-run equilibrium, a large decrease in government purchases will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. expansionary; lower; potential B. expansionary; higher; potential C. recessionary; lower; potential D. recessionary; lower; lower

What is "game theory"?

What will be an ideal response?

The difference between taxes and government spending is called: a. household saving. b. national saving

c. net tax. d. public saving.

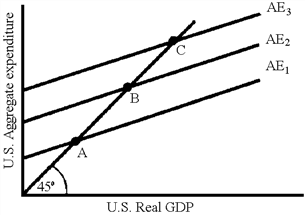

Figure 36-7

?

A. a European economic expansion B. A decrease in the money supply C. An increase in the interest rate D. An increase in the U.S. price level