Determine the tax rate. Round to the nearest cent or nearest hundredth.Assessed property value: $4,238,000Expenses to be funded by property tax: $219,000Tax per amount of assessed value: $100

A. $0.52 per $100

B. $5.17 per $100

C. $19.35 per $100

D. $1.94 per $100

Answer: B

You might also like to view...

The number of electrical outlets needed in an office building depends on the number of offices and the number of employees. If there are f offices and e employees, then the number of outlets needed is

?

A. Functional notation:

B. Functional notation:

C. Functional notation:

D. Functional notation:

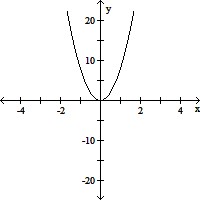

Choose the equation that matches the graph.

A. 8x2 = -y B. 8x2 = y C. 8y2 = x D. x2 = 8y

Create the requested drawing.The given figure illustrates a three-step fractal recursive process using the letter M. Using a similar progression, construct fractals with the letter Y.

What will be an ideal response?

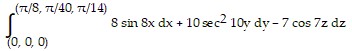

Evaluate. The differential is exact.

A. 1 B. 2 C. 4 D. 0