Explain how corporate profits are taxed twice.

What will be an ideal response?

Corporate profits are taxed by the corporate income tax first. Second, dividends paid out of profits are taxed as personal income of the stockholders. If the company does not pay dividends but the value of the stock goes up, the stockholder will pay capital gains tax when he or she sells the stock.

You might also like to view...

If the value of the marginal product of physical capital is $20 and the value of the marginal product of labor is $5, the highest price that a firm should pay for an additional unit of physical capital is:

A) $4. B) $5. C) $20. D) $100.

When the Fed makes open-market sales bank

a. withdrawals and lending increase. b. withdrawals increase and lending decreases. c. deposits and lending increase. d. deposits increase and lending decreases.

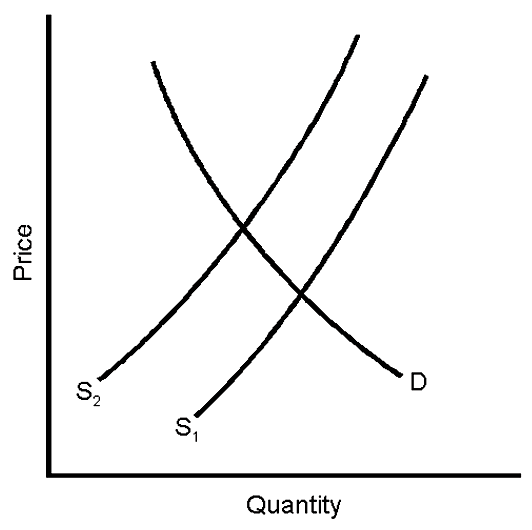

A shift from S1 to S2 causes equilibrium price to __________ and quantity to __________.

A. rise; rise

B. fall; fall

C. rise; fall

D. fall; rise

Explain why the optimal amount of pollution is often not zero

What will be an ideal response?