Charlie is claimed as a dependent by his parents in 2018. He received $8,000 during the year from a part-time acting job, which was his only income. What is his standard deduction?

A) $1,050

B) $12,000

C) $8,000

D) $8,350

D) $8,350

For a dependent, the standard deduction is the greater of earned income plus $350 or $1,050, but no more than the current year regular standard deduction amount.

You might also like to view...

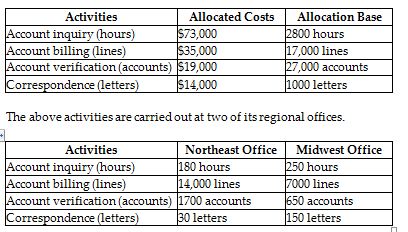

Royal Rotisserie Company, a manufacturer of kitchen ovens, had the following activities, allocated costs, and allocation bases:

How much of the account inquiry cost will be assigned to the Midwest Office? (Round any intermediate calculations to two decimal places and your final answer to the nearest dollar.)

A) $16,946

B) $72,996

C) $26,070

D) $6518

Using a linear regression program, the term ‘Intercept' refers to the fixed cost

Indicate whether the statement is true or false

Typical grievance rates in unionized employers are about 10 grievances per 100 employees per year.

Answer the following statement true (T) or false (F)

The house ________ Jackson built is on Mulberry Street

a. which b. that