Paletta Corporation has provided the following information concerning a capital budgeting project: Investment required in equipment$280,000 Expected life of the project 4 Salvage value of equipment$0 Annual sales$660,000 Annual cash operating expenses$470,000 One-time renovation expense in year 3$80,000 The company's income tax rate is 30% and its after-tax discount rate is 7%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The total cash flow net of income taxes in year 3 is:

A. $98,000

B. $74,000

C. $154,000

D. $110,000

Answer: A

You might also like to view...

The board of directors declared a $0.50 per share cash dividend on common stock, and the corporation had 10,000 shares authorized and 6,000 shares outstanding. The journal entry for the dividend declaration would include a debit to

a. Retained Earnings, $5,000; b. Retained Earnings, $6,000; c. Cash, $5,000; d. Cash, $10,000; e. none of these.

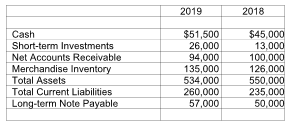

What is the 2019 current ratio? (Round your answer to two decimal places.)

The financial statements of Trenton Office Supply include the following items:

A) 0.85

B) 0.57

C) 1.18

D) 1.68

Green Gardens is a click-and-mortar company that sells gardening and landscaping goods and equipment

When customers are unable to find a product they need on the shelves of their local Green Gardens store, customers order the product online with the help of the in-store ordering machine. Which of the following best describes the ordering machine? A) kiosk B) digital catalog C) podcast D) tablet E) online networks

What is the importance of packaging?