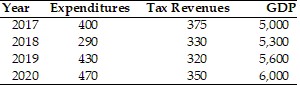

Suppose that initially there is no public debt. Using the above table, the public debt over this four-year period would have

Suppose that initially there is no public debt. Using the above table, the public debt over this four-year period would have

A. increased by $1,375.

B. decreased by $1,590.

C. decreased by $100.

D. increased by $215.

Answer: D

You might also like to view...

Refer to Figure 19-4. The equilibrium exchange rate is at A, $3/pound. Suppose the British government pegs its currency at $4/pound. At the pegged exchange rate,

A) there is a surplus of pounds equal to 600 million. B) there is a shortage of pounds equal to 200 million. C) there is a surplus of pounds equal to 400 million. D) there is a shortage of pounds equal to 400 million. E) there is a shortage of pounds equal to 600 million.

The standard deviation around an expected value is a useful measure of

A) expected value of an asset. B) economic value of an asset. C) the difference between the best-case return of an asset and its worst-case return. D) deviation of an asset's actual returns from its expected returns.

An IOU reflecting the corporation's promise to pay the holder a fixed sum of money at a designated maturity date plus an annual interest payment until maturity is

a. a bond b. a stock certificate c. a prospectus d. a golden parachute e. an underwriting note

The substitution effect of a price change ________ consistent with the Law of Demand.

A. is always B. is never C. is usually D. for inferior goods is not