The term tax incidence refers to

a. whether buyers or sellers of a good are required to send tax payments to the government.

b. whether the demand curve or the supply curve shifts when the tax is imposed.

c. the distribution of the tax burden between buyers and sellers.

d. widespread view that taxes (and death) are the only certainties in life.

c

You might also like to view...

Suppose you withdraw $500 from your checking account deposit and bury it in a jar in your back yard. If the required reserve ratio is 10 percent, checking account deposits in the banking system as a whole could drop up to a maximum of

A) $0. B) $50. C) $500. D) $5,000.

A jar has 20 red jelly beans and 40 black jelly beans. If you pick a red jelly bean and put it back, what are the odds of picking a black jelly bean next?

A) 20/40 B) 20/60 C) 40/60 D) 1 (100%)

In a perfectly competitive market, consumer surplus typically is

A) positive. B) negative. C) zero. D) undefined.

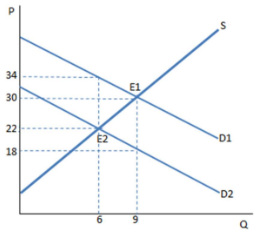

The graph shown demonstrates a tax on buyers. Which of the following can be said about the effect of this tax?

A. The price paid by buyers is greater than that received by sellers, and the difference is the tax wedge.

B. The price paid by buyers is less than that received by sellers, and the difference is the total tax revenue.

C. The price paid by buyers is greater than that received by sellers, and the difference is the total tax revenue.

D. The price paid by buyers and received by sellers is higher than it was before the tax was imposed.