The expectations-augmented Phillips curve is

? = ?e - 3(u - 0.05).

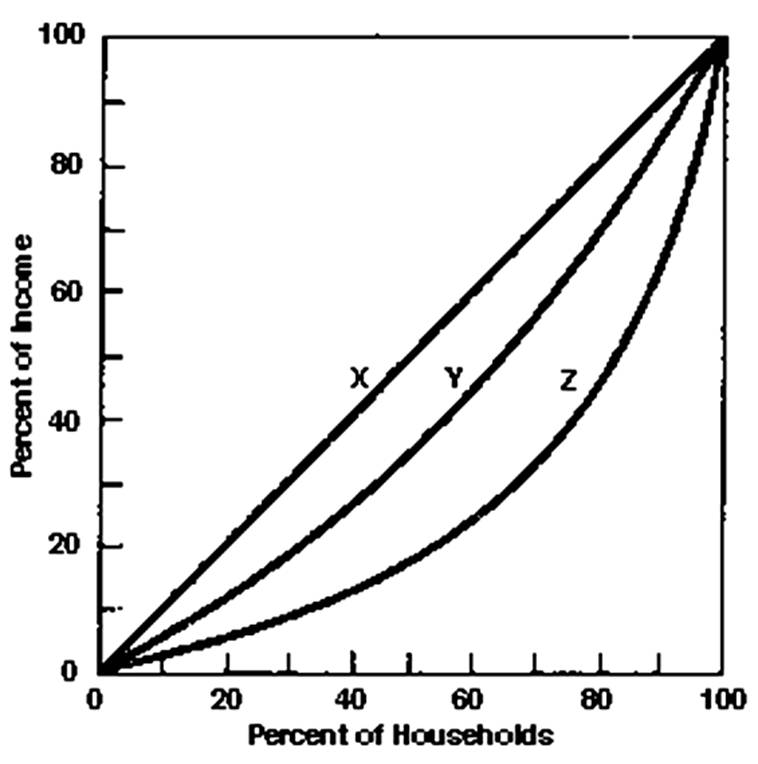

(a) Graph the long-run Phillips curve and the short-run Phillips curve for an expected inflation rate of 0.03. If the Fed chooses to keep the actual inflation rate at 0.03, what will be the unemployment rate? Label the equilibrium point "A". What is the numerical value of the natural rate of unemployment?

(b) An aggregate demand shock (resulting from increased exports of goods) raises the inflation rate to 0.06 (the natural rate of unemployment and the expected inflation rate are not affected). Show what happens on your graph. Label the equilibrium point "B". What is the numerical value of the unemployment rate?

(c) In response to the aggregate demand shock, suppose the Fed allows the inflation rate of 0.06 to persist. Show what happens on your graph, labeling the equilibrium point "C". In the long run, what is the numerical value of the unemployment rate?

(d) From the situation in part (c), suppose a supply shock (an oil price increase) raises the natural rate of unemployment by .01 from its original value. If the expected inflation rate does not change, show what happens in your graph, labeling the equilibrium point "D".

(a) Point A is on the SRPC with expected inflation = .03 and on the LRPC with the natural rate of unemployment = .05, with inflation = .03.

(b) Point B is on the same SRPC as A, but has inflation = .06, so unemployment = .04.

(c) Point C is on the LRPC with the natural rate = .05 and on the SRPC with inflation = expected inflation = .06, so the unemployment rate = .05.

(d) Point D is on the LRPC with the natural rate = .06 and on a new SRPC with expected inflation = .06, and inflation = .06 as well.

You might also like to view...

Refer to the scenario above. In the dominant strategy equilibrium, the payoff to Firm A is ________

A) $1.2 million B) $3.0 million C) $3.5 million D) $2.5 million

Lessons that economists and policy makers have learned from the recent global financial crisis include

A) Developments in the financial sector have a far greater impact on economic activity than was earlier realized. B) The zero lower bound on interest rates can be a serious problem. C) The cost of cleaning up after a financial crisis is very high. D) Price and output stability do not ensure financial stability. E) All of the above.

If the price effect outweighs the income effect of a wage increase, the quantity of labor supplied will:

A. increase. B. decrease. C. remain the same. D. be negative.

What is the percentage of income received by the upper quintile on line Y?