If the price of inputs rises and personal income taxes rise:

a. Aggregate demand falls and aggregate supply rises.

b. Aggregate demand rises and aggregate supply rises.

c. Aggregate demand falls and aggregate supply falls.

d. Neither the aggregate demand nor the aggregate supply change.

e. None of the above.

.C

You might also like to view...

Which of the following scenarios would tend to raise the value of the U.S. dollar in foreign exchange markets?

A. An increase in the U.S. demand for foreign oil B. A rise in U.S. interest rates C. Enactment of contractionary fiscal policy in the United States D. Enactment of easy monetary policy in the United States

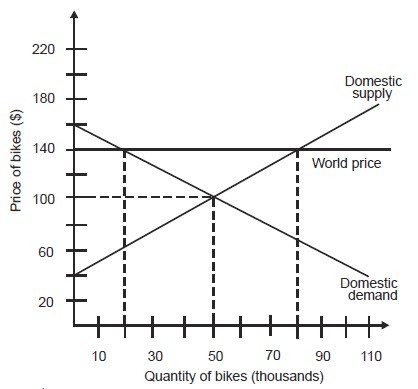

If this is a closed economy, what will the price of a bike be?

A. $20 B. $40 C. $140 D. $100

Suppose that ABC Beer Brewer faces a linear demand curve and that the current price for its beer is set at a point where the price elasticity is 0.6. If ABC Beer Brewer increases the product price, then the total revenue will:

A. increase if at the new price, the elasticity is still lower than 1. B. increase regardless of the size of the price increase. C. decrease regardless of the size of the price increase. D. increase if at the new price, the elasticity is greater than 1.

Government can correct for negative externalities by

A. increasing taxes or regulation. B. decreasing the costs to those responsible for the externality. C. decreasing taxes. D. allowing the market system to correct the problem.