Solve the problem. Refer to the table if necessary. Kyle is single and earned wages of $31,284. He received $323 in interest from a savings account. He contributed $468 to a tax-deferred retirement plan. He had $516 in itemized deductions from charitable contributions. Calculate his adjusted gross income.

Kyle is single and earned wages of $31,284. He received $323 in interest from a savings account. He contributed $468 to a tax-deferred retirement plan. He had $516 in itemized deductions from charitable contributions. Calculate his adjusted gross income.

A. $31,139

B. $30,623

C. $31,559

D. $32,075

Answer: A

You might also like to view...

Solve the problem.You need a loan of $120,000 to buy a home. You have a choice between a 30-year fixed rate loan at 4% and an ARM with a first-year rate of 2%. Suppose that the ARM rate rises to 7% at the start of the third year. Neglecting compounding and changes in principal, estimate how much extra you will be paying per month during the third year of the ARM over what you would have paid if you had taken the fixed rate loan.

A. $300 B. $280 C. $290 D. $270

Determine whether the given sequences are equal to each other.(k2 -9) and (k + 3)(k - 3)

A. equal B. not equal

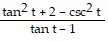

Establish the identity. +

+  =

=

What will be an ideal response?

Briefly explain the levels of Bronfenbrenner's bioecological approach.

What will be an ideal response?