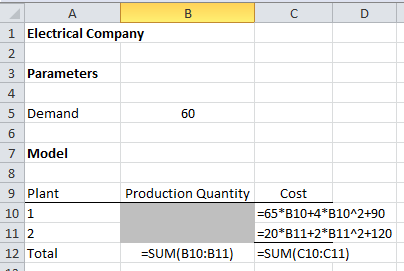

An Electrical Company has two manufacturing plants. The cost in dollars of producing an Amplifier at each of the two plants is given below. The cost of producing Q1 Amplifiers at the first plant is:

65Q1 + 4Q12+ 90

and the cost of producing Q2 Amplifiers at the second plant is:

?

20Q2 + 2Q22+ 120

The company needs to manufacture at least 60 Amplifiers to meet the received orders. How many Amplifiers should be produced at each of the plants to minimize the total production cost? Round the answers to two decimal places and the total cost to the nearest dollar value.

What will be an ideal response?

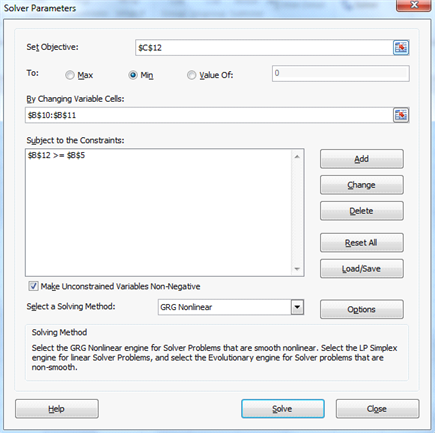

Min (65Q1 + 4Q12+ 90) + (20Q2 + 2Q22+ 120)

s.t.

Q1 + Q2 ? 60

Q1, Q2 ? 0

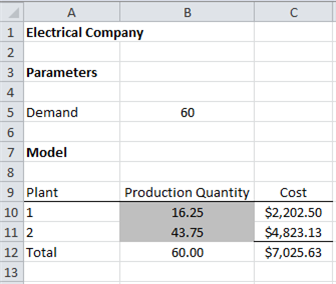

The optimal solution to this model is to produce 16.25 Amplifier's at plant 1 for a production cost of $2,202.50 and 43.75 Amplifier's at plant 2 for a production cost of $4,823.13. The total cost is $7,026. The spreadsheet model follows.

You might also like to view...

Perry Company acquires 100% of the stock of Hurley Corporation on January 1, 2017, for $3,800 cash. As of that date Hurley has the following trial balance: Debit CreditCash$500 Accounts receivable 600 Inventory 800 Buildings (net) (5 year life) 1,500 Equipment (net) (2 year life) 1,000 Land 900 Accounts payable $400 Long-term liabilities (due 12/31/20) 1,800 Common stock 1,000 Additional paid-in capital 600 Retained earnings 1,500 Total$5,300 $5,300 ??Net income and dividends reported by Hurley for 2017 and 2018 follow:? 20172018Net income$100 $120 Dividents 30 40 ??The fair value of Hurley's net assets that differ from their book values are listed

below:? Fair ValueBuildings$1,200 Equipment 1,250 Land 1,300 Long-term liabilities 1,700 ? ?Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life .?Compute the amount of Hurley's long-term liabilities that would be reported in a December 31, 2018, consolidated balance sheet. A. $1,650. B. $1,800. C. $3,500. D. $1,750. E. $1,700.

Refer to the following selected financial information from Shakley's Incorporated. Compute the company's times interest earned for Year 2. Year 2Year 1Net sales$478,500 $426,250 Cost of goods sold 276,300 250,120 Interest expense 9,700 10,700 Net income before tax 67,250 52,680 Net income after tax 46,050 39,900 Total assets 317,100 288,000 Total liabilities 181,400 167,300 Total equity 135,700 120,700

A. 4.8. B. 14.0. C. 5.8. D. 6.9. E. 7.9.

Jason wanted to have a virtual meeting where all participants could participate simultaneously so he opted to use ________.

A. videoconferencing B. the same computer C. a screen-sharing application D. a webinar E. discussion forum

What is the dissolution of a partnership?

What will be an ideal response?