When the government uses tax revenue to pay off portions of the national debt, total purchasing power in the economy

a. increases.

b. decreases.

c. is not affected at any level.

d. remains the same but changes individually.

d. remains the same but changes individually.

Economics

You might also like to view...

Explain how the money market determines the equilibrium interest rate

What will be an ideal response?

Economics

Explain the concept of Ricardian equivalence

What will be an ideal response?

Economics

Why do you hold money? According to the classical economists, the only motivation you have for holding money is for

a. transactions purposes b. precautionary purposes c. speculative purposes d. savings purposes e. liquidity purposes

Economics

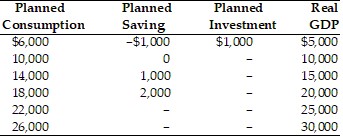

According to the above table, if real Gross Domestic Product (GDP) equals $30,000, what is the average propensity to consume?

According to the above table, if real Gross Domestic Product (GDP) equals $30,000, what is the average propensity to consume?

A. 0.8 B. 0.75 C. 0.87 D. 0.67

Economics