Tax loopholes reduce the excess tax burden on individuals.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Which of the following reasons describes the fundamental barrier to entry for the monopoly in the figure?

A) monopoly resources B) government regulation C) the production process D) Both a and b are correct.

If an action creates more total benefits for gainers than total harm to losers,

a. that action would be a Pareto improvement. b. taking that action would improve efficiency c. the government should step in to take that action d. a side payment exists that would make the action a Pareto improvement e. any side payment would make the action inefficient

Suppose that Christine values a baseball hat at $20, and Mark values one at $18 . The pretax price of a baseball hat is $14 . The government imposes a $5 tax on baseball hats, which raises the price to $19 . What is the deadweight loss from the tax?

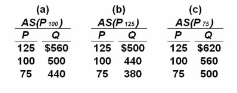

Refer to the information given. In the long run, a fall in the price level from 100 to 75 will:

Suppose the full employment level of real output (Q) for a hypothetical economy is $500, the

price level (P) initially is 100, and prices and wages are flexible both upward and downward.

Use the following short-run aggregate supply schedules to answer the question.

A. decrease real output from $500 to $440.

B. increase real output from $500 to $620.

C. change the aggregate supply schedule from (a) to (c) and produce an equilibrium level of

real output of $500.

D. change the aggregate supply schedule from (a) to (b) and produce an equilibrium level of

real output of $500.