Indicate whether each of the following events would lead to depreciation or appreciation of the U.S. dollar under a system of floating exchange rates. a. A drop in U.S. interest rates relative to foreign interest rates b. An increase in the preferences of foreign citizens for U.S. goods c. Faster economic growth in the United States relative to its trading partners d. A decrease in the U.S. money supply e. Rising U.S. inflation relative to foreign inflation

What will be an ideal response?

a. Depreciation of the dollar as foreign demand for dollars falls

b. Appreciation of the dollar as foreign demand for dollars rises

c. Depreciation of the dollar as U.S. demand for foreign currency rises

d. Appreciation of the dollar as rising interest rates increase foreign demand for dollars

e. Depreciation of the dollar as U.S. import demand rises and demand for U.S. export falls

You might also like to view...

Suppose a developing country experiences a reduction in machinery and capital equipment as foreign entrepreneurs decrease the amount of investment in the economy. As a result

A) the economy will move up along the long-run aggregate supply curve. B) the long-run aggregate supply curve will shift to the right. C) the long-run aggregate supply curve will shift to the left. D) the economy will move down along the long-run aggregate supply curve.

When the real quantity of money supplied equals the real quantity of money demanded, there is said to be

A) goods market equilibrium. B) asset market equilibrium. C) monetary neutrality. D) money illusion.

The production possibilities frontier represents all desirable combinations of two goods

a. True

b. False

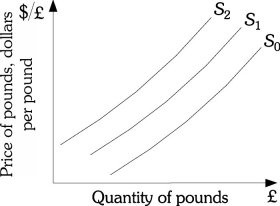

Refer to the information provided in Figure 34.3 below to answer the question(s) that follow. Figure 34.3Refer to Figure 34.3. Which of the following will shift the supply of pounds from S0 to S1?

Figure 34.3Refer to Figure 34.3. Which of the following will shift the supply of pounds from S0 to S1?

A. a decrease in the U.S. price level B. an increase in the British price level C. an increase in U.S. income D. a decrease in British income