The interest rate R in an NPV calculation should always

A) be the return that the firm could earn on a similar investment.

B) be the riskless interest rate (e.g., U.S. Treasury bills).

C) be the rate on corporate bonds.

D) be the rate of return available in the stock market.

E) be the interest rate at which the firm has to borrow.

A

You might also like to view...

Given the Production Function Q = 72X + 15X2 - X3, where Q = Output and X = Input

a. What is the Marginal Product (MP) when X = 8? b. What is the Average Product (AP) when X = 6? c. At what value of X will Q be at its maximum? d. At what value of X will Diminishing Returns set in?

You start working at age 20 and you plan to deposit $5,000 in a savings account every year for the next 45 years. a. At the end of this time, how much money will you have if the interest rate is 5%? b. You decide that's not enough money

How much will you have to save every year if you wish to have $1,000,000 when you retire?

Interest rate

What will be an ideal response?

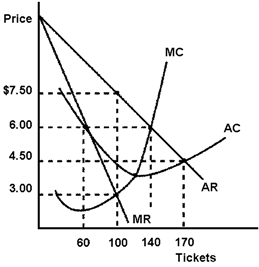

Figure 11-5

Crown Theater is the only movie theater in the city. Its cost and revenue curves are shown in Figure 11-5. Monopolist Crown Theater would set the price of its tickets at

a.

$7.50.

b.

$6.00.

c.

$4.50.

d.

$3.00.