If the income tax rate is 20 percent and the tax rate on consumption expenditure is 15 percent, then the tax wedge is

A) 2 percent.

B) 35 percent.

C) 300 percent.

D) 5 percent.

E) None of the above answers is correct.

B

You might also like to view...

In the above figure, once on PPF2, a country would grow slowest by producing at point

A) A. B) B. C) C. D) D.

New Keynesian economists generally argue that

A) there is an exploitable tradeoff between unemployment and inflation. B) changes in aggregate demand will have relatively greater effects on real GDP when firms change prices less frequently. C) activist policy can be used to reduce the fluctuations in real GDP. D) all of the above

A tariff is a tax placed on

a. an exported good and it lowers the domestic price of the good below the world price. b. an exported good and it ensures that the domestic price of the good stays the same as the world price. c. an imported good and it lowers the domestic price of the good below the world price. d. an imported good and it raises the domestic price of the good above the world price.

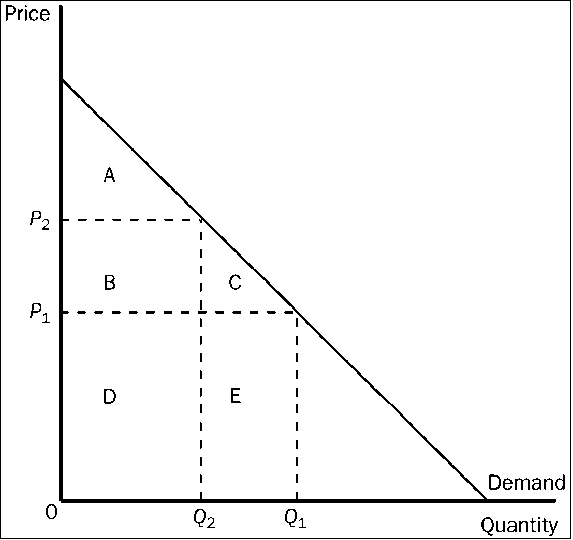

Figure 3-17

Refer to . When the price rises from P1 to P2, consumer surplus

a.

increases by an amount equal to A.

b.

decreases by an amount equal to B + C.

c.

increases by an amount equal to B + C.

d.

decreases by an amount equal to C.

v